Construya crédito comercial y

Acceso a capital

Eliminamos las conjeturas al obtener préstamos comerciales, Líneas de

Crédito y Crédito Empresarial de Construcción.¡Método probado y comprobado para acceder a capital para su negocio!

Hemos ayudado a miles de empresas a utilizar un enfoque simplificado de capital y financiación. Lo ayudamos a comprender y mejorar más de 100 factores de credibilidad bancaria, establecer y utilizar su crédito comercial y conectarlo con corredores y prestamistas para obtener préstamos y líneas de crédito.

Resultados rápidos junto con soluciones financieras a largo plazo para su negocio

En un entorno acelerado, los dueños de negocios necesitan resultados y RÁPIDO... Puede contar con nosotros para ayudarlo

obtenga el capital que necesita a corto y largo plazo Y proporcione un capital a largo plazo

solución financiera para su crecimiento.

¿Cuánto tiempo lleva generar crédito comercial?

¿Cuánto tiempo lleva generar crédito comercial?

Establecer crédito comercial es un proceso. Pero no tiene por qué ser necesario

para siempre. A menudo verá que una empresa tarda tres años en generar crédito.Si bien puede ser útil estar en el negocio durante tanto tiempo, puede crear un buen perfil crediticio y puntaje crediticio para pequeñas empresas mucho antes con la plataforma MyCompanyCredit.Capital comercial y préstamos a plazo

Su negocio necesita opciones.

Ofrecemos muchos tipos diferentes de préstamos para satisfacer sus necesidades específicas.

Financiamiento basado en ingresos

La financiación basada en ingresos es una forma de financiación que permite a las empresas recibir capital a cambio de un porcentaje de sus ingresos futuros.

Esta opción puede ser beneficiosa para las empresas que

tener dificultades para obtener préstamos tradicionales o

inversiones.

Préstamos a plazo y líneas de crédito

Úselo para inversiones en su negocio, como

proyectos de expansión o grandes compras.

Obtenga una suma global única de efectivo por adelantado,

con la opción de solicitar más cuando estés

medio pagado

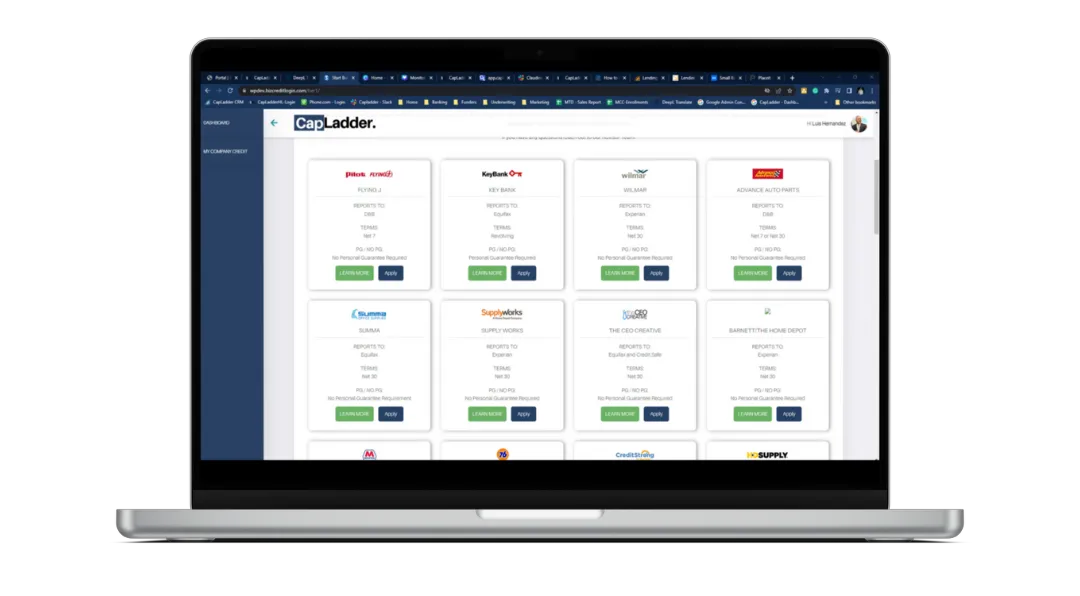

Plataforma MiEmpresaCrédito

La plataforma MyCompanyCredit puede ayudarle a generar crédito comercial haciendo el trabajo pesado por usted. Contamos con un equipo dedicado a encontrar y mantener cientos de cuentas de crédito comerciales.

Equipo dedicado al éxito del cliente

Cada cliente es diferente y necesita más de un programa único para todos. Su asesor de crédito dedicado lo guiará en cada paso para acceder al crédito que su empresa merece.

¡Método probado y comprobado para acceder a capital para su negocio!

Hemos ayudado a miles de empresas a utilizar un enfoque simplificado de capital y financiación. Lo ayudamos a comprender y mejorar más de 100 factores de credibilidad bancaria, establecer y utilizar su crédito comercial y conectarlo con corredores y prestamistas para obtener préstamos y líneas de crédito.

Plataforma MyCompanyCredit con Tecnología de coincidencia de proveedores

Características

La tecnología y la comunicación se unen: manténgase conectado en la plataforma MyCompanyCredit.

Coincidenciade proveedores

Conéctese con proveedores listos para extender su crédito comercial - ¡AHORA!

Correo electrónico

Su asesor de crédito dedicado está disponible todos los días para responder todas sus preguntas.

Mensajes de texto

¿El correo electrónico es demasiado lento para sus necesidades? ¡Lo tenemos cubierto! ¡Simplemente envía un mensaje de texto y listo!

Cualificaciones simplificadas

Cumpla con los requisitos de elegibilidad rápidamente y acceda a recursos crediticios que nunca supo que existían.

Programación de citas

Programe una sesión con su asesor de crédito y conéctese a través de pantalla compartida.

Avisos

Manténgase conectado y actualizado con nuestro tablón de anuncios. Desde proveedores hasta las últimas novedades.

Conoce a Spencer

Spencer tuvo los mismos obstáculos que tú, pero claro,

nos encontró...

Combinación perfecta: capital y crédito

Es hora de dejar de poner curitas a corto plazo para resolver las necesidades de capital a largo plazo.

Las oportunidades se presentan todos los días y, para esas situaciones, puede contar con nosotros para conseguirle el capital que necesita AHORA.

Pero también aprovechemos la oportunidad para comenzar a construir su perfil crediticio comercial y obtener acceso a capital al que siempre podrá acceder.¿Tengo una pregunta?

A la derecha encontrará respuestas a las preguntas más frecuentes que recibimos. No dude en comunicarse con nosotros si tiene más preguntas y estaremos encantados de responderlas.Escuche a nuestros clientes